Local governments could “weaken” if this property tax law dies, ratings agency says

Counties and municipalities will feel a budget crunch if the state Legislature doesn’t renew a 2 percent cap on the salaries police and firefighters can win through arbitration, a Wall Street Rating agency warned Wednesday. Echoing local government officials who’ve warned of impending tax hikes and spending cuts if the cap expires Dec. 31, Fitch Ratings… Read the rest of this entry »

Counties and municipalities will feel a budget crunch if the state Legislature doesn’t renew a 2 percent cap on the salaries police and firefighters can win through arbitration, a Wall Street Rating agency warned Wednesday. Echoing local government officials who’ve warned of impending tax hikes and spending cuts if the cap expires Dec. 31, Fitch Ratings… Read the rest of this entry »

Aberdeen Mayor Supports O’Scanlon’s Efforts To Limit Property Tax Hikes

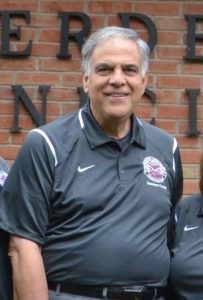

We haven’t heard from Jersey City Mayor Steve Fulop since Assemblyman Declan O’Scanlon challenged him to pressure Assembly Speaker Vincent Prieto to put the extension of the 2% limit on arbitration awards for police and firefighter salary contracts up for a vote. But Aberdeen Mayor Fred Tagliarini, a Democrat, called to say that he supports O’Scanlon’s effort.

“The 2% arbitration cap is a very powerful tool in stabilizing property taxes,” Tagliarini said in a phone interview with MMM. “I don’t know any mayor, Democrat or Republican, who wants it to expire. The cap should be extended before it expires in December.” Read the rest of this entry »

Posted: October 14th, 2017 | Author: Art Gallagher | Filed under: Monmouth County | Tags: 13th legislative district, Aberdeen, Aberdeen Mayor Fred Tagliarini, Arbitration Award Task Force, Assembly Speaker Vincent Prieto, Assemblyman Declan O'Scanlon, Interest Arbitration Cap, Jersey City Mayor Steve Fulop, LD 13, Monmouth County News, New Jersey, NJ Legislature, NJ Property Taxes | Comments Off on Aberdeen Mayor Supports O’Scanlon’s Efforts To Limit Property Tax HikesLocal leaders warn: Your property taxes will rise unless this happens

TRENTON — New Jersey’s 2 percent cap on police and firefighter arbitration awards must be renewed, or else taxpayers will see their services cut and property taxes rise, local government leaders said Friday. The cap on awards police and fire unions can win through interest arbitration sunsets at the end of the year. New Jersey mayors… Read the rest of this entry »

TRENTON — New Jersey’s 2 percent cap on police and firefighter arbitration awards must be renewed, or else taxpayers will see their services cut and property taxes rise, local government leaders said Friday. The cap on awards police and fire unions can win through interest arbitration sunsets at the end of the year. New Jersey mayors… Read the rest of this entry »

O’Scanlon calls for arbitration cap’s extension to control property taxes

TRENTON, N.J. – Calling the arbitration award cap one of the most important reforms implemented to control property taxes, Assemblyman Declan O’Scanlon said today that if the cap isn’t permanently extended taxpayers will face tax increases, draconian cuts to municipal services or both. O’Scanlon was a prime sponsor of the original cap law and vocal advocate of the extension. He was the only legislator appointed by the governor to sit on the Interest Arbitration Task Force.

TRENTON, N.J. – Calling the arbitration award cap one of the most important reforms implemented to control property taxes, Assemblyman Declan O’Scanlon said today that if the cap isn’t permanently extended taxpayers will face tax increases, draconian cuts to municipal services or both. O’Scanlon was a prime sponsor of the original cap law and vocal advocate of the extension. He was the only legislator appointed by the governor to sit on the Interest Arbitration Task Force.

“There’s no question that the cap has been successful and is an essential tool for municipalities to keep expenses and property taxes contained,” said O’Scanlon (R-Monmouth). “Every report we’ve done to date has been absolutely consistent and shows the arbitration and tax cap are working together as intended. You can’t keep the tax cap in place without the arbitration cap. You would create a mathematically untenable situation. And it isn’t just police and fire salary costs that are affected, there is a ripple effect throughout all salary expenses.” Read the rest of this entry »

Posted: September 22nd, 2017 | Author: admin | Filed under: Declan O'Scanlon, Monmouth County News, New Jersey, Property Taxes | Tags: 13th legislative district, Assemblyman Declan O'Scanlon, Declan O'Scanlon, Interest Arbitration Cap, LD 13, New Jersey, Property Taxes | 1 Comment »O’Scanlon forces Assembly vote on property tax cap effectiveness

Democrats punt on property tax reform

Trenton, NJ- Assemblyman Declan O’Scanlon, Jr. invoked a parliamentary rule on the floor of the Assembly on Thursday to force a vote on his bill that would remove the sunset provision on the arbitration cap of police and fireman salaries.

Trenton, NJ- Assemblyman Declan O’Scanlon, Jr. invoked a parliamentary rule on the floor of the Assembly on Thursday to force a vote on his bill that would remove the sunset provision on the arbitration cap of police and fireman salaries.

The arbitration cap was institution as part of the 2010 landmark property tax reform legislation that capped New Jersey property tax growth at 2% per year. The initial cap expired in 2014 and was renewed in 2014 with a sunset provision for the end of this year. O’Scanlon’s bill, A-2123,would make the 2% arbitration cap permanent.

Posted: June 10th, 2017 | Author: Art Gallagher | Filed under: Declan O'Scanlon, Monmouth County News, New Jersey, NJ State Legislature, Property Taxes | Tags: Declan O'Scanlon, Eric Houghtaling, Interest Arbitration Cap, Joann Downey, Monmouth County News, New Jersey, Police and Firemen Salaries, Property Taxes | 1 Comment »Prieto says he and Christie have found ‘common ground’ on renewal of key property tax law

Prieto says he and Christie have found ‘common ground’ on renewal of key property tax law (via NJ.com)

Prieto says he and Christie have found ‘common ground’ on renewal of key property tax law (via NJ.com)

TRENTON ‐ After a two-and-a-half-month stalemate, Assembly Speaker Vincent Prieto (D-Hudson) and Gov. Chris Christie have reached “common ground” on renewing a crucial law that mayors say has taken a significant bite out of property tax growth…

Extend Key Property Tax Reform – Earn the Respect We Claim to Seek.

By Assemblyman Declan O’Scanlon

When Gov. Christie came to office in 2010, he took action to address the biggest problem New Jerseyans have faced for decades – property taxes. Working with the Legislature, historic tax reforms were signed into law. These included a two percent limit on property tax levies, increased health and pension contributions by public employees and a two percent cap on awards arbitrators can grant when towns and their unions can’t agree on a contract.

When Gov. Christie came to office in 2010, he took action to address the biggest problem New Jerseyans have faced for decades – property taxes. Working with the Legislature, historic tax reforms were signed into law. These included a two percent limit on property tax levies, increased health and pension contributions by public employees and a two percent cap on awards arbitrators can grant when towns and their unions can’t agree on a contract.

These cost control tools are working. Recent property tax data shows the average property tax bill grew by 1.7 percent in 2013 and by the lowest consistent rate in decades since the reforms were passed. While our ultimate goal is to actually cut property taxes, slowing their growth is an essential first step.

The clock is now counting down to the destruction of the delicate framework that has successfully controlled our property taxes. An essential component of that framework – the arbitration award cap which enables local officials to control their largest costs – expired on April 1 of this year. The first contracts exempt from the cap will expire in June. That will be a disaster for property taxpayers throughout New Jersey. Without an honest and effective arbitration award cap, the property tax cap will fail.

The state’s interest arbitration cap law is one of the primary reasons we have turned the tide on the escalation of property taxes. According to the Public Employment Relations Commission, from January 2011 (when the arbitration law took effect) to September 2013, average raises in local contracts, whether through arbitration or negotiations, were 1.86 percent — the lowest in at least 20 years.

Posted: May 4th, 2014 | Author: admin | Filed under: Declan O'Scanlon, NJ State Legislature, Property Tax Tool Kit, Property Taxes | Tags: Assemblyman Declan O'Scanlon, Interest Arbitration Cap, Property Tax Cap, Property Tax Tool Kit, Property Taxes | 4 Comments »Christie and Prieto negotiating over renewal of key NJ property tax law

Christie and Prieto negotiating over renewal of key NJ property tax law (via NJ.com)

Christie and Prieto negotiating over renewal of key NJ property tax law (via NJ.com)

TRENTON — State Assembly Speaker Vincent Prieto is negotiating with Gov. Chris Christie on renewing of a law that limits raises to some police and firefighters to help curtail property tax increases. “I am in conversations with the governor and…

Christie calls on Prieto to renew key NJ property tax law

Christie calls on Prieto to renew key NJ property tax law (via NJ.com)

Christie calls on Prieto to renew key NJ property tax law (via NJ.com)

TRENTON — After spending months combating scandal, Gov. Chris Christie today returned to a familiar setting and an old target: standing in front of dozens of supporters to pressure the state Assembly to pass a key bill. Backed by dozens of county…