Former Dem Assemblyman takes Gopal to task for false and misleading campaign mail

By Michael J. Panter

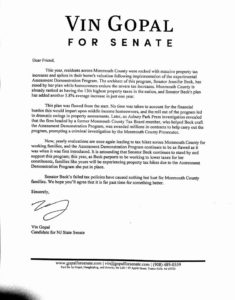

Like Kevin Asadi and other residents, I recently received the letter from Senate candidate Vin Gopal which denounces the Assessment Demonstration Program (the “ADP”), implemented in 2013, as the source of high property taxes.

Like Kevin Asadi and other residents, I recently received the letter from Senate candidate Vin Gopal which denounces the Assessment Demonstration Program (the “ADP”), implemented in 2013, as the source of high property taxes.

Since I have run in four state elections in Monmouth County, I have been in Mr. Gopal’s shoes. Political operatives refer to the weeks before an election as the “silly season”, since candidates will say almost anything about their opponents to generate a headline.

However, there is a line which should never be crossed – candidates should not issue false or misleading information, since it not only subjects them to legal liability, but most importantly, it does a disservice to taxpayers.

I sincerely doubt that Mr. Gopal authored this letter himself, although he is ultimately responsible for its content. I’ve spoken with his supporters who describe him as a bright and thoughtful individual, and this letter was not the work of someone possessing those characteristics.

Like all candidates, Mr. Gopal’s campaign was likely handed two notebooks from his consultants. Polling, which confirmed that property taxes are the paramount issue to voters, and opposition research containing a detailed analysis of Sen. Beck’s voting history.

The singular goal is to then connect Sen. Beck’s votes to high property taxes in any way possible.

The staffer who likely penned the letter for that purpose clearly had no understanding of the property tax system or the ADP, as Mr. Aladi eloquently described in his response.

Since this letter also included a thinly-veiled attack on a local business I founded and one of our partners (without naming either), I felt compelled to correct Mr. Gopal’s false and misleading statements. I didn’t want to do this, since I have gone to great lengths to stay out of the political sandbox since my last Assembly term ended in 2008.

First, the letter clumsily blames “massive property tax increases” on the ADP, to lay the groundwork for its attack on Sen. Beck by linking her to this program. The only problem with those statements is that the ADP has been a resounding success.

I will not repeat the facts contained in Mr. Asadi’s explanation of how Mr. Gopal’s letter misconstrues both the tax system and the ADP’s reforms, so let me offer some additional facts.

2015 was the first year in which the ADP affected assessments, and it resulted in tax decreases for one-third of Monmouth property owners. While this meant that two-thirds experienced increases, in prior years that figure was nearly 100%.

Countywide, the average tax change (the combination of all increases and decreases) was an increase of $124, or 30% below the 2014 state average. The actual increase was even lower, since much of it resulted from thousands of temporary Superstorm Sandy tax breaks being eliminated.

The ADP also saved taxpayers millions since it required annual assessment corrections to market value, so that appeals became less necessary. From 2008-2014, if even 50% of Monmouth homeowners who filed appeals hired attorneys, they would have paid more than $7 million in legal fees.

The ADP also changed the calendar for municipal budgets and appeal filings, which eliminated costly short-term borrowing by towns to replace (already budgeted) lost revenue from successful appeals.

Some may validly ask “Despite these facts, can Mike Panter be trusted in defending the ADP, when his company has been awarded contracts in that field?”

Great question. If the ADP were discontinued tomorrow, my company would be exponentially more profitable for one simple reason: under the old system, firms like ours are paid fees which are more than 300% higher than we earn for nearly identical projects under the ADP.

This is an additional source of significant taxpayer savings, and as the owner of several properties in Monmouth County, I want those savings to continue.

Second, the letter labels Sen. Beck as the “the architect” of the ADP and states that a partner in my firm “helped Beck craft the ADP” during his service on the Monmouth County Tax Board.

Let me offer some history, and insight into the legislative process.

The former Board member to whom Mr. Gopal referred is Dan Kelly, whom he labels as the “head” of my company, when in fact he is a minority member who only joined the firm the year after he was not re-appointed to the Board.

The development of the ADP began in Monmouth years before Sen. Beck took office, and many years before Mr. Kelly served on the Board.

After years of work (undertaken by a County employee who received no compensation), the program was proposed in the Assembly and Senate in 2011. It was sponsored by a wide array of Republicans and Democrats, and was passed via a series of unanimous, bi-partisan votes.

These votes included 5 separate legislative committees, and votes before the full Senate (36-0) and Assembly (78-0).

Despite being my opponent in past elections, I applaud Senator Beck for thinking outside the box, and helping to bring this innovative program to life for the benefit of taxpayers.

That said, it is wholly inaccurate to label Sen. Beck the “architect” of the ADP, which preceded her service by years.

The ADP then received the support of the NJ Division of Taxation and the Governor. The associations of Tax Assessors in both Monmouth and Burlington Counties then voted to implement the ADP in their respective counties.

At that point, following the unanimous approvals of over 200 elected and appointed officials, the Monmouth County Tax Board (on which Mr. Kelly served), approved the ADP’s implementation in 2013 as a final step in a decade-long process. The Board’s vote was also unanimous among all Republican and Democratic members.

For these reasons, Mr. Gopal’s contention that Mr. Kelly “helped Beck craft the ADP” is pure fiction. It is the equivalent of stating that a painter who helped apply a final coat to the Empire State building before it opened, was the architect and builder of that structure.

The letter then attempts to further tarnish Sen. Beck by ominously noting that the ADP spurred a “criminal investigation”.

The letter inexcusably omits the fact that this “investigation” was officially concluded many months ago, with no findings of wrong-doing by any individual or business involved in the ADP.

Including this reference in a campaign mailer exhibits a willingness to harm a local business and its employees for political gain – those who could be Mr. Gopal’s future constituents.

I will offer a piece of information, on the record, which is not publicly known – having received confirmation from the Federal Bureau of Investigation that I am entitled to do so.

Just this year, multiple individuals have been interviewed by the Monmouth County Prosecutor and the FBI with respect to one question: who were the real parties behind the false information provided to law enforcement, which prompted their (now concluded) investigation at taxpayer expense?

There is an ongoing trial to compel Monmouth County to disclose records which might yield this answer, and whether the “anonymous” allegations were in fact a scheme to benefit a party with a direct financial interest in seeing the ADP fail.

If false information was knowingly provided to law enforcement for that purpose, as I believe, there will be significant criminal and civil liability.

Finally, the letter notes that my firm has been awarded “millions in contracts” under the ADP.

My company is the only firm in our sector which has never given a political contribution, either as a business or from any individual partner.

We have been solicited, including by candidates supported by Mr. Gopal during his tenure as a county chairman.

We are also the only firm to my knowledge, that has a policy of refusing to accept any contract on a “no bid” basis.

Unlike legal, engineering and other firms, which routinely received taxpayer-funded contacts on a “no bid” basis, every contract within the ADP is publicly advertised and competitively bid.

In every instance of a contract award, the lowest bidder has been successful – whether our firm or others. This transparency is consistent with common sense, and has saved more tax revenue.

I’ll conclude with an invitation to Mr. Gopal. Despite everything, my hope is that whomever represents us in the State Legislature is well-informed about the critical issue of property taxes.

I would be more than happy to discuss the tax system and the ADP with him, and to direct him to sources with further information. I also wish success upon anyone elected this November.

Michael J. Panter represented Colts Neck, East Windsor, Englishtown, Fair Haven, Freehold Borough, Freehold Township, Hightstown, Little Silver Borough, Manalapan, Marlboro, Millstone, Oceanport, Red Bank, Shrewsbury Borough, Shrewsbury Township, Tinton Falls, what was then the 12th Legislative District, in the New Jersey General Assembly from 2004 till 2008. He is a principal of Realty Data Systems and the managing partner of an investment advisory firm.

“Bright and Thoughtful?”

This gentleman reminds me of the old fashioned “true” liberals – they actually believed in seeking dialogue and debate, not the politics of personal destruction.

It is sickening what the current generation of leftists (not liberals) do to seize power.

Kudos to this gentleman for setting the record straight and calling out the former dem county chairman for his lies and mistruths.

I urge Vin Gopal to apologize and resign as a candidate and let another run in his place so a real dialogue and debate can discuss the property tax debacle in our state and how to solve this problem which harms all property owners, especially senor citizens.

Politicians of both parties – WAKE UP! As a senior citizen and property taxpayer, I am sick and tired of the inefficiencies of government wasting our tax dollars. Have we ever looked at a county wide system of policing and education to provide more efficient and cost effective methods of providing these services?

How many school superintendents and school business administrators/business offices do we really need? How many lawyers do we really need representing school boards? How many school employee union negotiations do we need to have?

The special interests (administrators, unions, lawyers) all want decentralization because it means more jobs and money for them. What about the taxpayers and voters? Will any politician listen to us?

While a likely motivation is to protect his company, I applaud the writer for at least speaking out, clarifying information, and setting records straight. Too bad that the continuing, emotional, erroneous, nasty and slick, expensive fast sound- bite ads will, hit the taxpayers’ nerves, and cause the intended fatal blows- we have heard some$4-6 million may well be spent, in the 11th, alone. In an admittedly rough GOP year, appears “Mr. Murphy’s Money” is steamrolling right on through this state. Not good, given their seemingly hell- bent agenda, of taxing and spending NJ into bankrupt oblivion, unchecked, and continuing in earnest, come January.

Tom Stokes, I applaud you for this comment “I urge Vin Gopal to apologize and resign as a candidate.”

I really do, but sadly I suspect hell will freeze over first. AAA for effort though 🙂

Based upon an “anonymous letter”

“Beck had called for Clark to step down as county tax administrator while the prosecutor’s investigation was ongoing”

Why would any sitting Senator interfer and inject her false narrative with such a statement calling someone guilty before any investigation was concluded? What was her agenda? She had no regard for a human being’s livelihood.

Why would anyone want her to represent our State when “Libery and Justice for All” should exist? Hopefully our 11th wakes up and votes her out!

Tom Stokes: We are not going to get county-wide school districts any time soon, but it is not entirely the fault of special interests. Small school districts allow our state to remain segregated. And some parents want segregation.

In 2009, when Gov. Corzine ordered County Superintendents to look at opportunities to consolidate school districts, a few districts in Monmouth County were identified as possible candidates. The instant opposition to even studying the idea of consolidation did not come from special interests, it came from parents:

http://themonmouthjournal.com/local-parents-question-school-regionalization-plan-p346-1.htm

(The studies were completed in March 2010, but the DOE under Gov. Christie has taken no action on them and declined to release them publicly: http://www.app.com/story/opinion/columnists/2014/10/14/editorial-release-county-school-consolidation-plans/17271041/.)

The Red Bank schools had been trying to consolidate since at least 1995:

http://www.nytimes.com/1995/02/03/nyregion/school-district-seeks-a-partner-in-vain.html

We know that too much spending, too much hiring of friends and family, too much unions’ pressure,too much ego, as to the running of the little fiefdoms, too much local comfort of “how it’s always been,” all contribute to the conundrum of this, the most expensive state to live in. Does anyone believe that, barring legislation to force municipal and school district consolidations, that anyone will ever give up and give in? Seriously doubt it! Only with some towns or districts eventually going bankrupt, and others being forced to take them, will result in any new efficiencies/ economies of scale, in NJ. Expanding shared service and buying co-ops will help, but I do not see people giving up their jobs and hiring capabilities, and that coveted name plaque and title, any time soon.

if a County High School or 2 existed how much money would be saved, if any. Vocational schools work well, High Tech High and Mast work, perhaps it’s Time for more County magnet high schools.

If several towns merged high schools and ran the school in a college settings, would money be saved? Students would be better prepared for College and I’m sure a costs savings overall. Old school thinking and behaviors need to change with the times.

Never say never

Any studies out there?