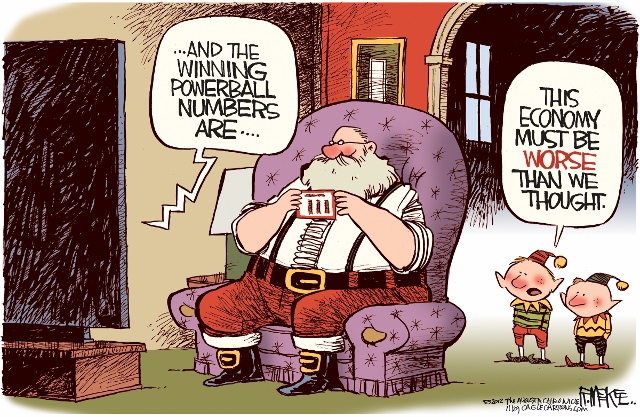

How much is the Powerball Jackpot worth after tax?

Got your ticket(s) yet?

If you win, take the cash option. Taxes are probably going up on the rich next year.

The jackpot is now up to $550 million.

Under current tax law, if you take the 30 year annuity your annual $18,333,333 will be taxed $4,583,333 by the IRS and $1,980,000 by the State if you live in New Jersey, for a net annual payment of $11,770,000.

If you take the $360,200,000 cash jackpot, the feds will take $90,050,000 and New Jersey will take $38,901,600, leaving you with a net payment of $231,248,400.

Source: USAMEGA.com