N.J. “millionaires tax”: Soak the rich, drown the state

By Scott Sipprelle. First published at nj.com

State Sen. Shirley Turner’s recent proposal to hit the state’s top taxpayers with a new “millionaires tax” is dangerous nonsense straight out of the soak-the-rich economic playbook. “It’s really about fairness,” said Turner (D-Mercer). “This governor has coddled the wealthy, but they need to pay their fair share.”

Leaving aside the fundamental question of why her proposed 10.75 percent top tax rate is the “fair” level, there is a more glaring problem with Turner’s proposal: It will make fiscal problems in New Jersey far worse.

New Jersey is in a deep financial hole because our politicians have spent money without ever evaluating whether the funding source is competitive and sustainable. The resulting debate about how to resolve these structural imbalances has become a spirited fight, as it deserves to be.

But regardless of one’s philosophical leanings or party affiliation, we should all be able to agree on one thing: We must do everything possible to encourage work and investment in New Jersey in order to fuel the economic furnace that generates government’s desperately needed tax revenues.

Politicians love the notion that they can merely increase your tax rate and generate a proportionally equivalent increase in tax revenues. But this is not the way the world really works.

Taxes change behavior. Drivers will cross state lines to save on gasoline tax. Taxpayers move to Florida to save on their income tax. When a special tax on millionaires a few years ago in Maryland failed to deliver its expected revenue boost, Democratic Gov. Martin O’Malley decided against bringing it back, focusing instead on spending cuts to balance his state’s budget.

Closer to home, New York state enacted a surtax on its top earners in 2009 as an emergency measure to help manage through the recession. Today, despite a recovering economy, New York’s underlying fiscal problems are worse than ever.

Recognizing that tax surcharges don’t solve problems, only prolong them, Gov. Andrew Cuomo has decided against extending the surtax.

New Jersey, which has an identical tax rate to New York’s on its top incomes, will have a top rate that is 57 percent higher than our neighbor in 2012 if Turner has her way.

The lesson across states wrestling with revenue shortfalls is clear: Raising taxes is no panacea because wealth is mobile.

New Jersey’s residents are the most highly taxed in the nation, and employers are steering clear of the state as a result. New Jersey lost more than 10,000 jobs per month in 2009, and job erosion continued into 2010 despite an economic recovery that added 1 million jobs nationally.

New Jersey currently generates a startling 41 percent of its income tax receipts from the top 1 percent of its taxpayers, a precarious reliance that the rating agency Standard & Poor’s said could contribute to “revenue volatility,” as it downgraded the state’s credit rating.

Turner needs to confront the hard truth: There is a limit to how much businesses and high-income residents can be taxed before they simply move away, taking our best hope for new investment, jobs and economic growth with them.

Turner says let the voters decide on the millionaires tax, punting tax policy to a ballot referendum. She might be surprised by the result.

Last November, one state did put a referendum on its ballot to implement a special tax of 9 percent on incomes greater than $500,000. It happened in Washington state, one of eight states with no income tax at all. That state has also been a relative stalwart economically. Washington voters rejected the special tax by a nearly 2-to-1 margin.

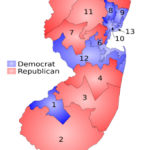

As a result of the recent U.S. Census, Washington will gain a seat in the House of Representatives, owing to its large population growth over the past decade, while New Jersey will lose a seat after a population gain below the national average.

Citizens vote with their pocketbooks and also with their feet.

When will New Jersey politicians learn that lesson?

Scott Sipprelle is president of the Lincoln Club of New Jersey and was the 2010 Republican candidate for Congress in the state’s 12th Congressional District

scott, what would it take for you to move to district 6???

He doesn’t have to move to CD 6, he wasn’t a resident of Holt’s district when he ran last year.

THAT SAID, it sure would be nice if he did move in.

Soak them some more,and we will have a mass Exodus to the states with little or no income tax’

Finally, someone who explains things in understandable terms. Can we draft him to run in 2012?

Agree with this of course, but the super rich need to be careful when advocating in their own interests.

Freespeaker you are incorrect he lives in the 12th and ran in the 12th.

As to haha, the real point here is if you were savy enough to make millions you are in the best position to know what you and others in your tax bracket are willing to pay.

Also given his background in economy I would rather take his advocacy on economic issues than that of our President who has never been a business owner.

With NYC plan to reduce the Millionares tax just like Corzine did , and drop the commuters tax the Garden State might shortly see an income tax revenue boost without a tax increase of any kind on wealthy individuals as Turner has proposed. Governor Cuomo favors allowing an income tax surcharge on his state’s wealthiest residents to expire at the end of 2011. For any New Jersey residents, who happen to commute to New York; they are probably aware of the taxes they pay towards New York and hence they would be equally impacted by Cuomo’s decision as the Empire State’s residents.

Based on estimates by the Office of Legislative Services, such a move by Cuomo could generate roughly $350 million for New Jersey’s budget by 2013.

Spoken like a wealthy man. Isn’t it time for you to “biddy biddy bum” somewhere?