OPINION: SENATE VOTE NEXT LOGICAL STEP IN OBAMACARE REPEAL

By Laurie Ehlbeck

Obamacare has been, to put it mildly, burdensome for small businesses in New Jersey. Soon, the Senate will have a chance to do something about it.

Obamacare has been, to put it mildly, burdensome for small businesses in New Jersey. Soon, the Senate will have a chance to do something about it.

Year after year, when the National Federation of Independent Business surveys its members, they say their number one priority is healthcare, but the Affordable Care Act, better known as Obamacare, has made things more difficult for them. Its onerous taxes and mandates have increased costs and reduced choices.

Repealing Obamacare shouldn’t be a partisan issue. The law has failed in its central promise, which is to make healthcare affordable. Premiums for small businesses have skyrocketed. The law forced the cancellation of insurance policies for millions of Americans who were happy with their plans. Insurance companies have abandoned the exchange marketplaces, leaving Americans in many parts of the country with one option or no options at all. Even former President Bill Clinton called Obamacare “the craziest thing in the world.” He said, “The people who are getting killed in this deal are small business people and individuals who make just a little too much to get any of these subsidies.”

That’s why NFIB New Jersey is calling on Senators Corey Booker and Bob Menendez to vote “yes” on the Senate plan, the Better Care Reconciliation Act.

Small business has long supported repealing and replacing Obamacare. NFIB opposed the healthcare bill when it passed, and we challenged its constitutionality before the Supreme Court in NFIB v. Sebelius.

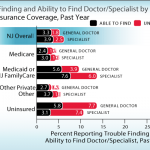

Not only does the law harm small businesses, it harms their employees. According to the federal government’s own research, small businesses’ health insurance costs increased and benefit flexibility decreased under Obamacare, resulting in 25 percent fewer small businesses offering health insurance within five years of the law’s enactment.

The Senate bill provides massive tax relief by eliminating or delaying 11 of the most burdensome Obamacare taxes, which are crushing small businesses and driving up costs. It also eliminates the punishing mandate penalties that discourage job creation, expansion, and investment.

This is a crucial moment for our senators. We hope they remember that small business employs most of the state’s private-sector workforce. It’s the backbone of our economy. Obamacare is a massive impediment to growth and new jobs, and this week our senators have a chance to enact change that will help small businesses.

Laurie Ehlbeck is state director of the National Federation of Independent Business, New Jersey’s leading small-business association.

So if property taxes in our 565 towns, 599 school boards with 550,000 public employees have become confiscatory, health insurance costs are INSANE – at least for us.

So I talked to a friend in Wyoming who is similar age and similar coverage who pays $600 per month for health insurance, or $7,200 per year. He has a hospital in town, has had several operations. He can’t afford to pay more without a life stylye change.

My wife and I have a small business who lost our Aetna policy several years ago when they stopped writing in NJ due to the unaffordable Affordable Care Act. Essentially Horizon’s BCBS became the only game in town and acted accordingly presenting us with a 41% premium increase in 2017 alone and pushing our insurance (including deductibles) to $2,600 per month, or $31,200 per year.

Turns out Horizon’s BCBS are sitting on $3 billion in surplus and many more billions in loss reserves. Having audited many non-profits over the years including hospitals and charity orgs, in many cases the only real difference is salaries are higher at the top and earnings are replaced with surplus or reserves.

In my view, many of the so called medial related non-profits are simply businesses disguised by an accounting protocol. I do agree there are lots of good jobs associated with our hospitals.

There is no vigorous competition. The ONLY other carrier that we know of is Qualcare which we got a better deal. We need to be able to buy health insurance across state lines and have many insurance companies competing for our business like they do for car, life and property insurance etc.

Then we hear about Riverview Hospital (which is a business) controlling the most expensive real estate in Red Bank and paying less property taxes than 25 houses and gobbling up more ratables using the advantage of untaxed cash flow. According to the TRT, In Red Bank, Riverview Medical Center is one a handful of not-for-profits that actually provide an annual payment in lieu of taxes (PILOT).

According to Eugenia Poulos, Red Bank chief financial officer, the medical center contributed $166,322.86 for 2015 (see link below). The average property tax in Red Bank is $7,404 in 2015 (see link of all towns below) ($166,323 Riverview payment in lieu of taxes / $7,404 avg prop bill = 22 houses).

https://patch.com/new-jersey/redbank/who-pays-njs-biggest-smallest-property-tax-bills-check-red-bank

http://tworivertimes.com/lawmakers-propose-changes-to-tax-free-status-for-hospitals/

here’s the rest of what Bill Clinton said:

…..[T]he insurance model is totally nonsensical.

“It doesn’t make any sense. The insurance model doesn’t work here,” he said. “It’s not like life insurance; it’s not like casualty; it’s not like predicting floods. It doesn’t work.”

“So Hillary believes we should simply let people who are above the line — forgetting these subsidies — have access to affordable entry into the Medicare and Medicaid programs,” Clinton said. “They’ll all be covered. It will not hurt the program. We will not lose a lot of money, and we ought to do it.”