Expert Insight Into The COVID-19 Real Estate Market

A must read for homeowners, buyers, sellers and tenants

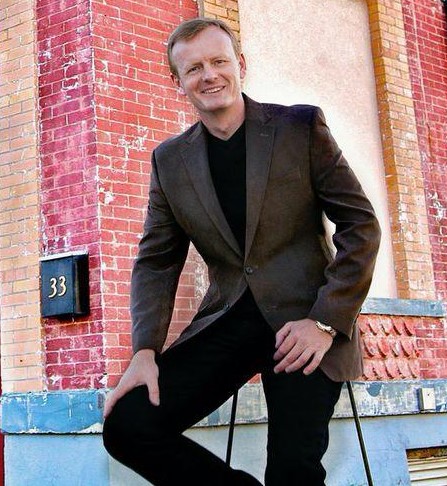

By Paul Ziajski, Atlantic Real Estate Brokers

Man, what a week! I feel like I’ve spent 200 hours on research, webinars and consults. This is truly an unprecedented event. The information is so fluid. I took some time to gather my thoughts and summarize what I’ve learned. It’s a long read but I hope that someone finds a useful piece of information. Have an awesome weekend and stay safe!

– The circumstances surrounding the current market conditions are, clearly, different from those that caused the financial and housing crisis in 2008. Although many agree that the housing market will experience a correction, very few are predicting that it will be impacted as severely as it was during the Great Recession.

– Many economists argue that we will experience a V or a U-shaped recovery; a drastic decline followed by a fairly quick recovery. The fundamentals of the economy were sound pre-COVID and, therefore, the expectation is that the economy will recover in the 4th quarter of 2020 and resume its expansion. There is an expectation of a 2 quarter economic contraction and of a global recession. Unfortunately, the damage has been done.

– The Fed has done a good job of getting ahead of the curve by injecting meaningful amounts of liquidity into the credit markets. We have, and likely will, continue to experience more market volatility but institutions are continuing to lend. The stimulus programs that have been designed to help the businesses and individuals are on unprecedented scale and have been rolled out quickly.

– The recovery of the housing market and its overall health depend largely on the health of the mortgage business. If liquidity dries up for some reason, all bets are off. Currently, the non-qualified mortgage market is just about non-existent. Some lenders have tightened up their standards by raising minimum credit scores.

– The expectation is that the housing market will experience a correction. However, there was an inventory shortage (particularly in the entry-level home market) pre-COVID and this shortage will not miraculously disappear so, it is widely expected that the demand for housing will be strong once again after we return to “normal.” Again, the health of the mortgage market is a caveat here.

– People really need to understand the current forbearance programs because I can see this causing an unintended consequence. Many banks are offering forbearance/deferrals for borrowers. This does not mean forgiveness. The deferred payments will have to be paid back at some point. If you plan to take advantage of a deferral, contact EACH lender and inquire when the deferred payments will be due. Some lenders may require that the deferred amount to be paid at the end of the period which means that you may be faced with several payments at once. Other lenders may spread the deferred amount over a longer period or may extend the maturity of the loan. When you don’t ask, the answer is always “no” so, don’t be shy to contact your lender and ask what they can do for you if you find yourself in a financial hardship. Ask for a deferral, temporary interest-only payments, and reduced interest on credit cards, etc. Speak with your accountant and wealth manager to establish a strategy.

– Similarly, tenants should be cautious about deferring rent payments. Evictions have been “frozen” for 90 days. This doesn’t mean that tenants shouldn’t pay rent if they are financially able to. Be proactive and reach out to your landlord if you think that you may be facing a hardship and can’t come up with the rent. This freeze will, eventually, be lifted and landlords will file for evictions if rent hasn’t been paid. Remember, landlords have mortgages, taxes, insurance and maintenance to pay also. We are ALL impacted by this unfortunate event. The rental inventory in our area has been challenging as well. If you have a landlord-tenancy case on your report, it’ll make it more difficult for you to secure another rental in the future. Real estate agents and landlords use services that not only pull your credit and criminal reports but also scrub court records for evictions.

– If you are planning to sell your home now, be aware that this is a volatile time. Although there are technologies that facilitate virtual showings, the current “stay-at-home” environment doesn’t lend itself to traditional marketing. Currently, NJ agents are permitted individual showings but are prohibited from hosting open houses. Sellers should be realistic and expect longer than usual times for marketing, municipal and home inspection, appraisals, mortgage commitments, etc. It is VERY important that the fair market value of your home is calculated properly. If your agent is choosing comparable sales from more than 3-6 months ago, you may find that those values don’t properly reflect the current values (I think that this will be even more important during the Summer months.) Further, your agent should provide you with a full CMA that includes accurate adjustments for property condition and characteristics. Bringing 3 listing sheets of comps to a presentation and saying “I think we should list at X” is never the right approach and particularly not now. Demand CURRENT pre-approvals or proof of funds from buyers submitting offers.

– Be informed when you’re approached by investors and wholesalers to sell your home. This is another reason why having an accurate fair market value of your home is so important. Investors and wholesalers typically expect to purchase at a discount to fair market value. Because they often buy in cash and can facilitate a closing in as little as 2 weeks, a REASONABLE discount may be appropriate. However, 50 cents on a dollar is not. Demand current proof of funds if anyone tells you that they are a cash buyer. Many investors use hard money to purchase homes but they may represent themselves as cash buyers. Hard money loans and cash are not the same. Also be mindful when working with wholesalers who assign the contract to another party before the transaction closes that, in this environment, it may be more difficult to assign a contract and that the risk of the transaction failing to close may be higher. I am an investor myself so, by no means, am I implying that these types of buyers should be avoided; just know the current and accurate value of your home.

Paul Ziajski of Middletown is the President of Atlantic Real Estate Brokers