Welle’s Tax Plan Would Increase Taxes For 21.3% of CD-4 Residents

Josh Welle, the progressive or centrist (depending on who he’s talking to) Democrat challenging Congressman Chris Smith in the fourth congressional district, proposed raising taxes on the top 5% of income earners yesterday during his appearance on FoxBusiness’s Cavuto: Coast to Coast.

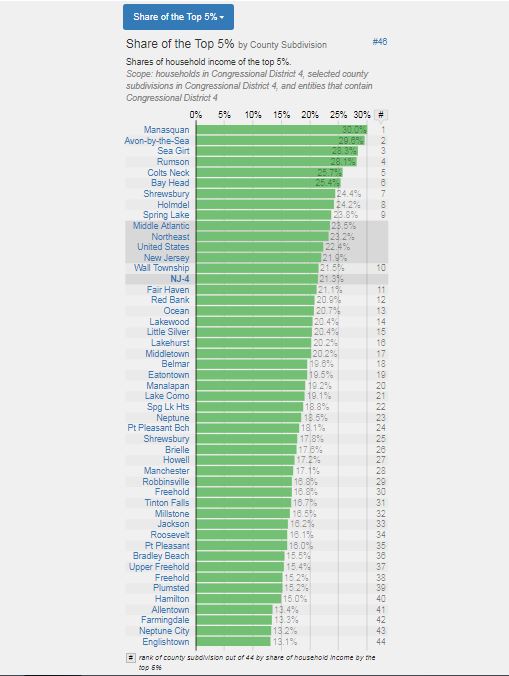

The Welle Tax would impact 21.3% of the households in New Jersey’s 4th Congressional District, according to data provided by StatisticalAtlas.com.

Welle’s justification for his proposed tax increase is reminiscent of President Obama’s “You didn’t build that” from the 2012 presidential campaign. He said the top 5% should pay more taxes because “their wealth was built on public goods,” “They were built on our roads, on our internet, on our school system, on our judiciary..”

CAVUTO: So you’re against those tax hikes? (Governor Murphy’s tax hikes)

WELLE: No. What I’m for, I’m for a tax hike for the top one percent or the top five percent in this country because their wealth was built on the backs of public goods. What I’m not in favor of in New Jersey—

CAVUTO: What do you mean their wealth was based on public goods?

WELLE: They were built on our roads, on our internet, on our school system, on our judiciary—I’ve been to 45 different countries—

CAVUTO: But you could argue that everybody’s been benefiting—

Welle said he would fight to rescind the limit on the SALT (state and local tax) deduction, something that Congressman Smith has already proposed, but the Welle Tax would increase taxes on more people in the district than the SALT deduction limit impacts negatively now.

Welle rolled his eyes, frowned, smirked, and shrugged his shoulders when Cavuto kept him on topic and prevented him from seguing into his stump speech.

Welle has been performing OK thus far in front of his friendly audiences with pre-screened questions and flash cards. He didn’t do so well with Cavuto, who wasn’t even tough on him.

As CD-4 voters get to know Josh between now and November, it is very likely they will Leave Welle enough alone and vote for Chris Smith.

The Classic version of FiveThirtyEight’s House model rates the probability of Smith being reelected at 93.34%. That was as of August 16 at 6 p.m., the evening before Welle embarrassed himself on Cavuto: Coast to Coast.

Lost In Space

If he doesn’t understand that everyone uses and benefits from public infrastructure, he isn’t ready for dog catcher.

That graph is seriously flawed.

Your household income has to be over $225,000 to make the top 5%.

https://l.facebook.com/l.php?u=https%3A%2F%2Fwww2.census.gov%2Fprograms-surveys%2Fcps%2Ftables%2Fhinc-05%2F2017%2Fhinc05.xls&h=AT1kP39zDV-PRgqp4LO16yNn_ZDiylK8ey8M0NZjS0YZmef62TVfRKT911qV-KfZeGtaUOv2D3F5K3Hi4S7sz_-pATrU27wnCKW_a_z2yVhOlu9Mb6SAGZCcNWPxd4vbdw

Only 6.9% of RB households have an income above $200,000.

https://l.facebook.com/l.php?u=https%3A%2F%2Ffactfinder.census.gov%2Fbkmk%2Ftable%2F1.0%2Fen%2FACS%2F16_5YR%2FS1901%2F1600000US3462430&h=AT2XEAkmxramhCvCi2bLwuDrUBtb5S_CW1ftEOQ_YNnAmWHBs_Ey8766AVv_3WsfHrczFcE6jJU9nfbNGSrIEcng4Z-kN-7bUxi25Nuwetjvo6BWhM8iyhF2sJaZyM2Mnw

So less than 6.9% of households in RB are in the top 5%.

Get your fake facts out of here. Everyone knows the graph in the story is the accurate one.

or the other 4 main over- taxed states, would someone with these dopey ideas be even considered a threat.. have no idea if/ when the light bulb will ever light, that many of these people are simply about re- distributing what people make from working, to those who don’t..pathetic..

Using the latest Census Data, top 5% income level is about $225k. So with this cursory glance, your cited figure would be less than 12% of CD4 households, probably less than 10%. The 21.3% figure is inflated, as is the NJ one, in all likelihood.

Raising taxes on the top end, who have benefited disproportionately from the post-2008 recovery, particularly those in FIRE, is hardly an unreasonable proposition.

If you actually cared about details, and not just gotchas, I’m sure this could be elaborated on. But that would require MMM not to act in bad faith, nearly constantly.

https://www.census.gov/mycd/?st=34&cd=04

Re: The Graphs

What is the source of the graphs? Not sure I saw that.

It appears to me that they are well researched and credible.

As noted in the text, with a link, the data is provided by StatisticalAtlas.com. The chart is also linked.

As stated, it’s the latest census data, from the 2016 American Community Survey (2016 ACS 1-year estimates, specifically).

Your source (StatisticalAtlas.com) is offering crunched data “from the US Census Bureau, specifically from the 2010 census, and from the 2009-2013 American Community Survey,” although I’m not entirely sure how they’re crunching things.

Misunderstood who the graph question was aimed at. Sorry.

In any case, Dan Riordan’s graphs above are from the Census’ Current Population Survey & the 2012-2016 American Community Survey 5-Year Estimates, respectively.

General point still stands.

Bottom line: those who toil and pay the most,are again soaked more, for those who don’t: it never ends: point stands..

Rob and Dan,

Do you think you or anyone else has a right to benefit from the income that results from the labor of someone whose income exceeds some threshold? If so, why?

Do you agree with Josh Welle’s policy statement that people who have already paid taxes that funded the construction of infrastructure should have higher taxes imposed upon them in the future for using the same infrastructure that they already paid for in pursuit of earning their living?

Enlighten us, please.

#njisthenewdetroit. Flee now while you still can.