Murphy claims bi-partisan support for property tax/charity scheme. Republicans disagree, call for NJ reforms

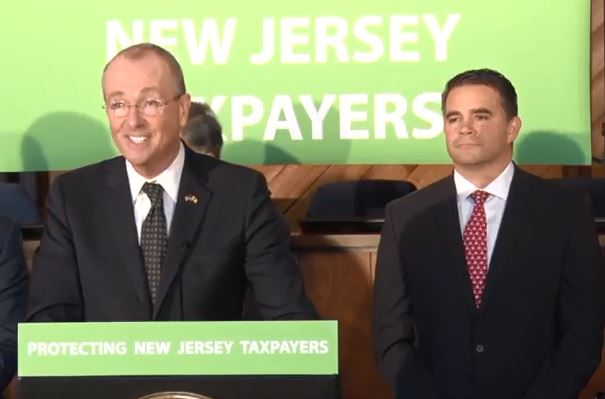

Marlboro, NJ-With Belmar Mayor Matt Doherty looking like Chris Christie standing behind Donald Trump on Super Tuesday — and four other Democrat mayors standing behind him, Governor Phil Murphy today declared he had bi-partisan support for his plan to have the state’s municipalities set up charities to accept donations in lieu of property taxes. Murphy said that the recent income tax reform passed by Congress and signed into law by President Trump is a tax increase on New Jersey’s middle class. The scheme he is proposing would, if allowed by the IRS, reverse the impact of the tax reform law’s $10,000 cap on the state and local tax (SALT) deduction.

Several New Jersey Republican leaders issued statements expressing skepticism about Murphy’s plan and urging him to reform New Jersey government to reduce the local tax burden.

Marlboro Mayor Jonathan Hornik, while introducing Murphy, said he has no idea is the plan will work, but it is worth a try. “Anybody who is not willing to try, does not belong in government,” Hornik said.

“When the disastrous federal tax legislation passed, I committed to pushing back and taking steps to ensure that the people of New Jersey are not subjected to unfair double taxation,” Governor Murphy said. “We have begun working with legislative leadership to protect our residents and prevent this plan from further hurting our taxpayers. We must eliminate any and all barriers to creating a system that will provide tax relief to property taxpayers who make charitable contributions to their municipality.”

Murphy said that 33 other states of programs that allow their residents to make charitable contributions for governmental purposes. He hopes the IRS will bless his plan.

Several New Jersey Republicans issued statements that ranged from skepticism to criticism of Murphy’s plan. Each argued for reducing the tax burden on New Jersey taxpayers.

“The problem for New Jersey’s overburdened taxpayers originates in Trenton, not with President Trump’s historic income tax reforms,” said Monmouth County Sheriff Shaun Golden, who is also the County Republican Chairman. “New Jersey’s ridiculously high income tax and property taxes are the problem. Governor Murphy’s scheme to classify property taxes as voluntary charitable contributions is a shell game that, in the unlikely event it is ruled legal, will further complicate a tax system that badly needs to be simplified. Governor Murphy’s scheme will not solve New Jersey’s tax burden.”

“Over the last ten years in Monmouth County, we have reduced spending by 7%, reduced the number of County employees by 25% and improved the quality of services provided to our residents while keeping their tax burden flat. Our state government needs the type of reform that we have demonstrated is possible.

“I urge Governor Murphy to stop campaigning against President Trump and get to work governing New Jersey. Monmouth County’s leaders stand ready to help.”

Golden also took a swipe at Hornik.

“It is fitting that the Governor chose to release this ill conceived plan with Marlboro Mayor Hornik,” Golden said. The mayor opted out of the countywide revaluation plan , meaning taxpayers across Monmouth subsidize the tax bill in Marlboro as home values have increased while not paying fair share – but then again I guess Mayor Hornik calls that charity.”

Senator Declan O’Scanlon (R-LD 13) said,“I’m happy to back any legitimate opportunity to save NJ property taxpayers’ money. But exploiting this technicality doesn’t seem acceptable to the IRS, which is critical if this is going to be real. Until then, this is more stunt than genuine solution.”

Introduced bill S-1858 yesterday. It will reinstate the arbitration award cap leaving salary decisions in hands of property taxpayers.Without this reform we will see the evisceration of the 2% property tax cap, slashed local services&higher property taxes. https://t.co/ZKx0Wj6bc3

— Declan O’Scanlon (@declanoscanlon) February 9, 2018

Congressman Leonard Lance (R-CD 7) released a letter that he wrote to Murphy asking him to lift the $10,000 cap on property tax deductions on New Jersey state income taxes.

“Capping taxpayers’ deductions on SALT negatively and disproportionately affects New Jersey residents compared to residents from other states. Repealing on the $10,000 property tax deduction for state income tax filers would alleviate some of that newly increased financial burden,” Lance wrote in his letter. “I respectfully request your advocacy and support for legislation that would eliminate New Jersey’s $10,000 cap on deductions for property taxes on taxpayers’ state income tax returns.”

State Senator Joe Pennacchio (R-LD 26) has introduced legislation what would lift the state property tax deduction cap. Pennacchio said of Murphy’s plan, “While I agree with the governor’s sentiment that we need to provide property tax relief to New Jerseyans, his charitable contribution scheme provides false hope rather than real solutions. I have no doubt that the Internal Revenue Service or Congress will strike down this concerted effort to evade federal taxes. We should focus on real solutions that actually lower the cost of government.”

Murphy’s Marlboro press conference can be viewed in the video below:

You CAN do it Sheriff Shaun Golden! Arrest those men, Phil Murphy and Jonathan Hornik, on charges of tax evasion, fraud, conspiracy to commit fraud, and all of the other IRIS statutes they are violating! This is the path to becoming future President Shaun Golden, and the right thing to do for this nation. I support you Shaun Golden; arrest these criminal, tax-evading, hypocrite Democrats Phil Murphy and Jonathan Hornik, and you may as well arrest Bob English too for supporting their illegal and criminal enterprises! America needs you Sheriff Shaun Golden! Now is the time; do it!

Title 26 USC § 7201

Attempt to evade or defeat tax

Any person who willfully attempts to evade or defeat any tax imposed by this title or the payment thereof shall, in addition to other penalties provided by law, be guilty of a felony and, upon conviction thereof:

Shall be imprisoned not more than 5 years

Or fined not more than $250,000 for individuals ($500,000 for corporations)

Or both, together with the costs of prosecution

Title 26 USC § 7202

Willful failure to collect or pay over tax

Any person required under this title to collect, account for, and pay over any tax imposed by this title who willfully fails to collect or truthfully account for and pay over such tax shall, in addition to penalties provide by the law, be guilty of a felony

Shall be imprisoned not more than 5 years

Or fined not more than $250,000 for individuals ($500,000 for corporations)

Or both , together with the costs of prosecution

Title 26 USC § 7203

Willful failure to file return, supply information, or pay tax

Any person required under this title to pay any estimated tax or tax, or required by this title or by regulations made under authority thereof to make a return, keep any records, or supply any information, who willfully fails to pay such estimated tax or tax, make such return, keep such records, or supply such information, at the time or times required by law or regulations, shall, in addition to other penalties provided by law, be guilty of a misdemeanor and, upon conviction thereof:

Shall be imprisoned not more than 1 years

Or fined not more than $100,000 for individuals ($200,000 for corporations)

Or both, together with cost of prosecution

Title 26 USC § 7206(1)

Fraud and false statements

Any Person who… (1) Declaration under penalties of perjury – Willfully makes and subscribes any return, statement, or other document, which contains or is verified by a written declaration that is made under the penalties of perjury, and which he does not believe to be true and correct as to every material matter; shall be guilty of a felony and, upon conviction thereof;

Shall be imprisoned not more than 3 years

Or fined not more than $250,000 for individuals ($500,000 for corporations)

Or both, together with cost of prosecution

Title 26 USC § 7206(2)

Fraud and false statements

Any person who…(2) Aid or assistance – Willfully aids or assists in, or procures, counsels, or advises the preparation or presentation under, or in connection with any matter arising under, the Internal Revenue laws, of a return, affidavit, claim, or other document, which is fraudulent or is false as to any material matter, whether or not such falsity or fraud is with the knowledge or consent of the person authorized or required to present such return, affidavit, claim, or document; shall be guilty of a felony and, upon conviction thereof:

Shall be imprisoned not more than 3 years

Or fined not more than $250,000 for individuals ($500,000 for corporations)

Or both, together with cost of prosecution

Title 26 USC § 7212(A)

Attempts to interfere with administration of Internal Revenue laws

Whoever corruptly or by force endeavors to intimidate or impede any officer or employee of the United States acting in an official capacity under this title, or in any other way corruptly or by force obstructs or impedes, or endeavors to obstruct or impede, the due administration of this title, upon conviction:

Shall be imprisoned not more than 3 years

Or fined not more than $250,000 for individuals ($500,000 for corporations)

Or both

Title 18 USC § 371

Conspiracy to commit offense or to defraud the United States

If two or more persons conspire either to commit any offense against the United States, or to defraud the United States, or any agency thereof in any manner or for any purpose, and one or more of such persons do any act to effect the object of the conspiracy, each:

Shall be imprisoned not more than 5 years

Or fined not more than $250,000 for individuals ($500,000 for corporations)

Or both

https://www.irs.gov/compliance/criminal-investigation/related-statutes-and-penalties-general-fraud

but no cigar, folks. Not the country’s fault that our taxes are so ridiculous that more and more are folding up their highly- taxed tents and getting the heck outa here. It’s the spending, stupids..