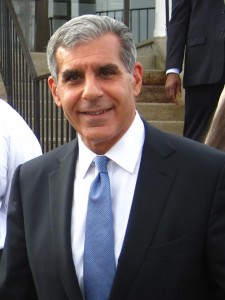

Kyrillos: “Millionaires Tax” hurts the poor and middle class

By Senator Joe Kyrillos

Nobody ever felt sorry for a millionaire. At least that’s the principle some Democrats in Trenton are banking on as they resurrect former Gov. Jon Corzine’s “millionaires tax” to close the expected budget gap for fiscal 2015. Proponents of this tax increase promise it will hit only the wealthy, but in fact, poor and middle-class families will ultimately shoulder the burden.

Of course, the term “millionaires tax” is a misnomer. New Jersey already taxes the income of millionaires at one of the highest rates in the nation — higher than 44 other states do. The so-called millionaires tax is just an expired tax increase that raises New Jersey’s top tax rate to about 11 percent, the third-highest in the United States.

Proponents of the millionaires tax imagine that the only reason people could oppose this tax hike is that they’re worried New Jersey’s well-to-do will run low on caviar if it’s passed.

Actually, what we’re worried about is the impact on New Jersey’s working families.

As it turns out, millionaires don’t like paying high taxes any more than the rest of us do. But unlike most of us, they can easily move out of New Jersey to avoid new tax hikes. For many, changing their tax residence is as simple as spending a few more weeks a year at their vacation home in Florida. They can keep a house in New Jersey to spend time with the grandkids, live for six months and one day in the Florida home, and voilà, they are Florida residents who no longer owe a dime in New Jersey taxes. As a bonus, their children will escape paying New Jersey’s highest-in-the-nation estate tax.

It’s little wonder that in 2010, the last year we had the old Corzine millionaires tax on the books, 88,000 individuals left New Jersey, taking with them a total annual income of $5.5 billion.

The millionaires tax could be more aptly named the “Goodbye New Jersey Tax.”

Remarkably, just 50 high-earning individuals in New Jersey pay 5 percent of the entire state income tax bill. That means the exit of just two or three top-earners can cost the state tens of millions of dollars in lost tax revenue. Those losses result in cuts to services for the poor or tax increases elsewhere. In short, the millionaires tax proposal suffers from a math problem: The numbers don’t add up.

Now Democrats in the Statehouse imagine that when millionaires leave, they take only their Lamborghinis with them. In fact, many of them take their businesses too.

A quarter of a million small business owners pay taxes on their income as individuals in our state. Many of them will be hit by the millionaires tax. The original millionaires tax kicked in at incomes of $500,000 — roughly the annual income of a small construction business. In New Jersey, small businesses employ about 1.6 million workers, and these workers are at risk of losing their jobs as operations move south to escape a mounting tax burden.

That’s why the Goodbye New Jersey Tax is a great job creation program — for Florida.

Don’t shed a tear for the rich as they head off to spend a few extra weeks at their vacation homes. They’ll be fine. But poor and middle-class New Jerseyans will be worse off, in terms of both job opportunities and access to public services funded by tax dollars once paid by the wealthy.

Even Democrats in other “deep blue” states have recognized that now is no time for tax hikes. New York Gov. Andrew Cuomo is actually trying to cut taxes on high-earning New Yorkers. As he puts it: “We’re trying to attract business. We’re trying to keep business here.”

Maryland and Massachusetts now tax millionaires’ income at roughly 5 percent; in Pennsylvania, it’s 3 percent. Meanwhile back in Trenton, Democrats threaten job creators with an 11 percent tax rate.

As our nation is still in the grips of a weak recovery, we should be working to attract job creators and capital to our great state — not to drive them away.

Joe Kyrillos has voted to make the middleclass state/County and Municipal workers put more into their health benefits and pension benefits. Now the Governor wants to renege with placing money into their pension systems. The workers are doing their part–let the millionaires engage in the same “shared sacrifice.” Remember that term when CC first came into office?

Isn’t time for the millionaires to pay their share?

http://www.nj.com/opinion/index.ssf/2014/06/nj_millionaires_tax_the_wealthy_exodus_is_a_myth_opinion.html#incart_river_default

MacInnes, a political hack and member of the thoroughly embarrassingly discredited Rutgers Board of Governors, flaunts his biased cluelessness. As the objective Tax Foundation clearly reports:

“Our Monday Map draws data from our interactive State Migration Calculator, and illustrates the interstate movement of income over the past decade (from 2000 to 2010). When a person moves to a new state, their income is added to the total of all other incomes in that state. This positively affects the total taxable income in his or her new state, and negatively affects the income in the state he or she left.

“The net aggregate adjusted income of migrants moving into or out of states between 2000 and 2010. Figures are in real 201 dollars. Does not nclude foreign immigration, births or deaths.

“Florida benefited the most—interstate migrants brought a net $67.3 billion dollars in annual income into the state between 2000 and 2010. The next two highest gainers were Arizona ($17.7 billion) and Texas ($17.6 billion). New York, on the other hand, lost the most income ($-45.6 billion), and is followed by California ($-29.4 billion) and Illinois ($-20.4 billion)..” –http://taxfoundation.org/blog/monday-map-migration-personal-income

And lo and behold which state is No. 4. Why it’s New Jersey, with the lost of $16 billion. What shameful group to be associated with!

“New Jersey’s government tax revenue is not the only income impacted by the wealthy fleeing the state. Other wealthy professionals who would be making enough to carry some of the burden find themselves leaving, as well, because their client pool in the state has diminished. This, the study finds, is true of many lawyers, accountants, agents, and other individuals whose clients are mostly in high income brackets. “When people move out of New Jersey,” the study finds, “the state not only loses the tax revenue from that person, it may also lose revenue because the income of other New Jersey professionals is likely impacted.”

Charities also lose out, as much of their revenue comes from philanthropic high-income individuals who can afford donations. Aggregate charitable donations decreased since the implementation of the millionaire’s tax, and the study found that many accountants and attorneys have told their clients to donate to charities outside of New Jersey to avoid the tax burden.

The study does not provide an answer to the problem, though it notes some of the potential sources: more and higher paid police officers than anywhere in America and more municipalities than any similarly-sized area in the country. More municipalities means more public officials to pay from a tax pool that is shrinking. Naturally, the study concludes that attracting wealthy New Jerseyans back to the state is a start, and lowering taxes is key for that.

As revenues continue to dwindle and New Jersey teeters on the brink of economic crisis, the state’s tax code will be at the forefront of government reforms. –http://www.breitbart.com/Big-Government/2014/03/18/Study-NJ-s-Budget-Crisis-Fueled-By-Exodus-Of-Wealthy-Residents-Fleeing-Taxes

Even the njo.com article on the Regent Atlantic report shows just how far out MacInnes is. This is the lede:

“Nearly 88,000 people took $5.5 billion with them when they left New Jersey in 2010 in search of states with lower taxes, according to a report by RegentAtlantic Capital, a Morristown-based investment adviser.

The data was drawn people who filed 2009 federal tax returns in New Jersey, and then filed in another state the next year.

According to the report, about 41 percent of the money went to Florida and 20 percent to Pennsylvania. In the case of both states, more money emigrated to them than immigrated to New Jersey. The Garden State saw $825.8 million head west across the Delaware River, and $569.6 million came with folks moving to New Jersey. About $778.6 million moved to Florida, while $264 million moved north to New Jersey from the Sunshine State.

The study found that the average income coming into New Jersey is about 50 percent less than the income leaving.” –http://www.nj.com/business/index.ssf/2014/03/about_55_billion_left_nj_in_tax_migration_study_finds.html

“You can accumulate assets in New Jersey — you can build a career here — but once that’s built you pretty much leave the state,” Regent Atlantic accountant Eric Furey told Bloomberg.

The money drain isn’t necessarily coming from retirees leaving, however, but rather from working age people, according to report, titled Exodus on the Parkway. The percentage of people between 25 and 44 years old leaving New Jersey in the first decade of the century was greater than any other demographic segment. Those people make up the bulk of the workforce.

If I’m doing the math right (and I am), the 88,000 individuals who departed with $5.5 billion in 2010 each earned $62,500. Even if we multiply that by 4, to represent a family of 4, that still gives a family income of $250,000.

This looks to me more like an “exodus” of middle managers being transferred to new positions than it does a mass migration of the wealthy to lower-tax states.

I get it that some people believe that the millionaires tax could do more harm than good but with that said, if you don’t want a millionaires tax, you still need to present a solution for the State to make its contributions since the Governors and the Legislatures number one achievement over the past four years (pension reform) has apparently evaporated with the State unable to pay its share this year (and next year?) due to far to rosy revenue projections by the administration.

There is incredible damage done by continuing to kick the can down the road to future years taxpayers.

From NJ Spotlight: “If Christie’s pension cuts stand, the state’s unfunded pension liability would jump by $6.4 billion over the next 13 months, and if he continued the same policy through his last budget in FY18, the state’s unfunded pension liability could jump from a projected $54.1 billion that year under the 2011 pension funding formula to between $70 billion and $75 billion”.

I never knew a poor person who provided jobs for others. The fact is that millionaires create small businesses and jobs.

Shoo them away and you will loose jobs, putting more and more tax burden on the middle class.

Granted, the unfunded pension liability is a problem. But you don’t fix cash flow problems by creating situations where you create job losses and decrease revenue normally gained through those jobs.

Every time tax rates are reduced ( as they were under Democrat JFK) the economy grows.

Econ 101 stuff folks.

FYI,

I do a lot of shopping at yard sales. A LOT. I can not tell you how many people are just emptying their houses and moving out of NJ because of the tax burdens.

Three today and that was out of just ten stops.

Upper income and middle income alike.

We ain’t seen nuttin’ yet. The “For Sale” signs are blossoming like never before.