Unemployment “Insurance” Needs To Be Reformed

By Art Gallagher

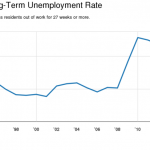

Assembly Minority Leader Alex DeCroce raised an important issue this week—the insolvency of the Unemployment Trust Fund which is in debt to the federal government for almost $2 billion–and then promptly torpedoed his message with a poor choice of words when he called those collecting “those people.”

Now the story in the media has become DeCroce’s insensitivity, his apology, the six figures he and his wife are collecting from their state jobs and their pensions. My friend Bob Ingle points out that DeCroce is taking the heat from his Democratic colleagues by attempting to change the subject to dual office holding.

My experience as beneficiary of unemployment insurance is very limited. In the late 80’s, the last time the economy was this bad, I lost a high paying job “through no fault of my own.” I went to the unemployment office, was interviewed and filled out forms. This was my first, and only to date, experience seeking any government assistance. I didn’t like it. Fortunately I was young and single with responsibilities for no one but myself.

Rather than take the handout, even though I had paid into it, I downsized my lifestyle by moving into a smaller apartment and took a low paying job that I was over qualified for.

I didn’t consider that a major decision at the time, but in retrospect it was a pivotal decision in my life. I never went back to “the corporate world.” I was happy and thriving in the “small business world.” It took a long time to get my income back to the level I enjoyed in “the corporate world.” When I realized I was tapped out and wasn’t so happy any longer working at the small business I was employed by I found that I couldn’t go back to the corporate world. I was a “stray cat.” Even if I could have gotten such a job, I would have hated it. So I started my own small business.

As an employer I became acquainted with the unemployment fund again. I was paying into it. For the first 8-10 years of I didn’t even notice it. Business was great and growing. I was hiring, rarely firing. Contributions to the unemployment fund were an insignificant portion of my quarterly payments to the State.

Toward the end of the boom, my most valuable employee informed me she was pregnant. The news was not as life changing to me as it was to her, yet it was a significant and unexpected development. She had not had a child in 20 years and was not planning another. I relied heavily on her. She knew the administrative aspects of my business better than I did. I didn’t know them at all! This major personal development in my trusted employee’s life exposed a major weakness in my business that would require an expensive adjustment.

Assuming the economy would continue to boom and that business would continue to thrive, my plan was for my most valuable employee to spend her pregnancy training her replacement while herself training for the new job that I invented for her to come back to after her pregnancy leave. It was an expensive plan, but it worked. The administrative aspects of my business became documented with a manual that my new hire referred to often as she mastered her job. My long term employee spent months answering questions, documenting answers and taking business courses from Brookdale online, preparing for her return.

Given that I was expecting her back, and given that business remained strong, I carried the cost of my long term employee’s health care during her pregnancy leave. It was a good thing I did, as there were major complications, the baby (who is now a brilliant and delightful 4 year old who is terribly disruptive when she comes to visit the business) needed surgery and a long quarantine period. The maternity costs and the baby’s early care cost almost $400,000. The care they received probably wouldn’t have been as good and the taxpayers would have picked up the tab had I not carried the heath care premiums.

But the downside for me was that a 3 month maternity leave turned into an 8 month maternity leave. When my employee came back to work, she said she could only handle part time. The truth was she probably wasn’t ready to work, but the pregnancy disability benefits had run out.

After a couple of months on part time, I told my employee I needed her full time. She quit. This gets me back to the Unemployment Trust Fund and its management.

Unbelievably to me, and over my objections, she was granted unemployment benefits. Why did I object? Because I had offered her a full time job, the offer was still on the table, but the folks managing the Unemployment Trust Fund gave her benefits instead.

A quarter, two or three later I noticed that my payment to the State had increased substantially. Figuring it was a mistake, I asked my bookkeeper for an explanation. No mistake, my unemployment insurance premiums had skyrocketed due to claims history. A large portion of the cost was the premium on my own salary. As the owner of a corporation I couldn’t collect on “insurance” I was paying for. This would be illegal in the private market.

Now, a few years later with an even higher claims history, my contribution to the Unemployment Trust Fund is 3-4 X higher than the quarterly payroll taxes I pay to the State, though the actual number is a great deal lower. This cost is a major impediment to me hiring new employees, as it is for hundreds, if not thousands of other small business owners.

There are legal and illegal ways around having to pay high unemployment premiums. The legal way, starting a new company with no history to pay employees is probably the option I’ll follow, if I decide to grow the business again. Employee leasing is also an option. Both options are unproductive and costly, but probably not as costly as paying 5+% of payroll into the insolvent Unemployment Trust Fund. Closing the existing corporation is not an easy option for me, and many other businesses, as the existing corporation owns assets that could not be transferred without costly legal, accounting and tax consequences. Small businesses owners are confronted with a choice of having to create complicated and costly corporate structures in order to grow, not to grow, or to cheat. Many will choose to cheat, which is an impediment to growth in the long run, and costly to the State treasury in the short and long run.

Cheating is a major issue on the beneficiary side of the unemployment equation that no one wants to talk about. There is no accountability for those receiving unemployment benefits. There may be no way of knowing how many people are gaming the system, working “off the books” while collecting. We all know it is happening.

As indelicate as DeCroce’s words were, he point was accurate. We need to give the unemployed more incentives to make the difficult but inevitable lifestyle choice decisions and find ways to survive economically either by accepting jobs they once never would have considered or starting businesses. We also need to remove the disincentives from businesses who want to employ people but won’t because the risks are too high for the potential returns.

Most importantly and not yet addressed in a major way, we need to bring management and accountability to the administration of the Unemployment Trust Fund.

Art, why don’t you create a separate company, like a staffing company, who would hire your employees, and your leasing company would pay them as contractors on 1099 so it’s the new company that would pay all the benefits and unemployment costs?

I had a n employee quit on me once to take a job with another company.

They lost the new job about 4 months later.

My business was held respnsible for the Workers comp Claim and my rates went up.

Figure that one out.

Yes the system needs to be reformed.

It should be restructured to act more like actual insurance.

Chris,

That is one of the options I was referring to in the fourth paragraph from the bottom. Sorry if I was unclear.

It’s an option, but, like I said a costly and unproductive option. The staffing company would have to file tax returns. The IRS will question why the old company no longer has payroll, etc.

Right now it doesn’t make sense to do because I’m down to only two employees. If I decide to grow the company again as the economy improves I’ll either do that or sign up with a employee leasing company.

Unemployment insurance, workers compensation, and NJ temporary disability insurance vary premiums based upon experience. For small businesses in particular, one claim can cause premiums to skyrocket for years.

Employees get desperate when no income is coming in, so they naturally will do whatever it takes to get benefits, driving up premium costs for the co-workers still working.

Businesses can offer supplemental disability coverage to employees as one way of minimizing these exposures. You valued employee story might have had a different ending if she had more than the state TDI.

[…] also extends unemployment benefits for an additional 13. … for the Volunteer Lawyers Project,Unemployment Insurance – New York Times (blog)President Signs Tax Cut Bill, Restores Unemployment Insurance13WHAM-TVThe […]